| Filed by the Registrant [X] | ||||

| Filed by a Party other than the Registrant [ ] | ||||

| Check the appropriate box: | ||||

| [ ] | Preliminary Proxy Statement | |||

| [ ] | Confidential, Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| [X] | Definitive Proxy Statement | |||

| [ ] | Definitive Additional Materials | |||

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i) | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the | |||

| 1) | Amount | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

__________

PNotice of 2016 Annual Meeting of ShareholdersROXY

NOTICEOF ANNUAL MEETINGOF SHAREHOLDERS

PROXYSTATEMENT

AND

2012 ANNUAL REPORT__________

Fellow Kroger Shareholders:

We beginIt is our 130th anniversary year with confidence.

The ways we listenpleasure to Customersinvite you to join our Board of Directors, senior leadership, and respond to their ever-changing needs have evolved through our history, and yet several clear principles have remained constant forother Kroger associates at The Kroger Co. familyAnnual Meeting of stores.

Our confidence is firmly rooted in Kroger’s strong foundation for growth. About 10 years ago we announced ourCustomer 1Shareholders.st business strategy, which truly puts the Customer at the center of how we manage our business. Through our focus on the Four Keys of our strategy – our people, products, price and the shopping experience –we are connecting with Customers in more powerful ways than ever before. Kroger’s identical store sales trend is the clearest measure of that growing connection. In 2012, Kroger achieved a retail industry-leading 37 consecutive quarters – more than nine years – of positive identical sales growth.

Late in 2012 we announcedaggressive new growth plans to expand Customer 1st into the next decade. The Company is investing in a targeted expansion strategy to increase square footage and store penetration in existing markets and enter new markets. Through additional capital investments in new and existing stores, new store formats, and new ways to connect with our Customers and Associates, including our digital connection, we expect to achieve a higher long-term financial target and increase Shareholder return.

A Year of Record Earnings and Focus on Shareholder Value

Kroger’sunique offering of better service, great products, an enjoyable shopping experienceand low prices and weekly specials continues to resonate with a full range of Customers. As a result, fiscal 2012 sales grew $6.4 billion for total revenue of $96.8 billion, making Krogerone of the largest retailers in the world. Net earnings were $1.5 billion or $2.77 per diluted share; this includes an $0.11 per diluted share benefit of the extra week. We achieved record earnings per share for the year, and grew adjusted net earnings per share by more than 16 percent.

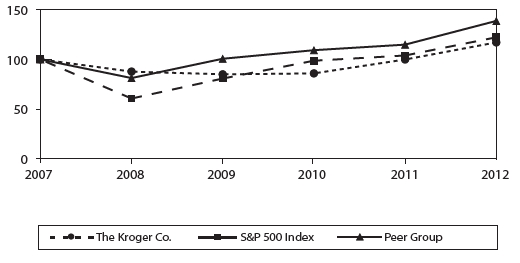

Our outstanding business results allowed Kroger to continue using free cash flow to reward shareholders.We increased our quarterly dividend by 30 percent and returned more than $1.5 billion to shareholders through dividends and stock buybacks in 2012. Since 2006, Kroger has paid nearly $1.6 billion in dividends to Shareholders. We have been able to accomplish this while maintaining our investment-grade credit rating and improving our debt leverage ratio and annual interest expense.Since January 2000, Kroger has returned $9.0 billion to Shareholders through share repurchases.

Now, what makes this best-in-class performance possible? A large part of the answer is simple: Our Great People. Associates in the Kroger family of stores are uniquely and authentically passionate for people and for delivering superior results. This is brought to life through their dedication tomaking the day better for every one of the more than seven million Customers who shop our stores daily – whether through a simple smile, solving a problem or helping Customers on a budget feed their family.

* * *

Celebration of Our Shared Heritage

Barney Kroger opened his first store in Cincinnati, Ohio on July 1, 1883. That his Company not only survived but is thriving 130 years later is an amazing accomplishment. And yet two of our banners have been in business even longer. In 1873, George Ralphs – founder of our Ralphs division – opened his first store in Los Angeles. Ten years earlier, in 1863, John C. Groub – founder of our Jay C division – opened his first store in Rockford, Indiana.

We are celebrating the shared heritage of our entire family of stores – a heritage of transformative growth and innovation that continues to inspire us today.

1

Transformative Growth

Kroger’s heritage is one of impressive growth – from being the first grocer in the nation to operate its own bakery in 1901, to operating 37 manufacturing facilities today; from small grocery stores averaging 3,000 square feet in 1930, to supermarkets averaging 12,000 square feet in 1960, to today’s Marketplace stores averaging 125,000 square feet; and from sales topping $1 billion for the first time in 1952 to sales well over $96 billion in 2012.

Our family of stores has grown by powerful combinations of strong regional banners, giving the Company the benefits of size without losing the local touch.

Innovation

Strengthening our connection with Customers begins with listening to them, and for 130 years Kroger has developed innovative ways to listen and respond. In 1959, Kroger executives began conducting “Kroger Calls,” door-to-door interviews with homemakers, to better understand the needs of our Customers. In the 1970s we became the first grocer to formalize Customer research, and last year we listened to nearly 2,000,000 individual Customers and learned important insights that we use to make merchandising decisions.

A more than decade-long partnership with dunnhumbyUSA, the leader in personalizing Customers’ experience of retailers and brands, helps us say that we know our Customers better than anyone. A great example of how we put this into practice is through ourLoyal Customer Mailing, or LCM, which we send to millions of households regularly throughout the year. The most recent LCM reached more than 11 million households, and 97 percent of recipients received an individualized set of coupons for the products they like and buy regularly –almost no two were alike. At redemption rates regularly topping 60 percent, our LCM continues to lead the industry.

Innovation at Kroger also means utilizing new technologies to meet Customer needs. In the early 1970s Kroger was the first retailer in the country to test now-ubiquitous electronic scanners at checkout. In just the last few years, we have pioneered Que Vision, our innovative faster checkout program that has reduced the time a Customer waits in line to check out, on average, from four minutes a few years ago to less than 30 seconds in our stores today.

Innovation is also at the heart of our sustainability efforts, aimed at improving today to protect tomorrow. Kroger created an innovative process to rescue safe, edible fresh products and donate them quickly to local food banks. This innovation has been replicated by other retailers and today fresh products make up more than half of the food distributed nationwide by Feeding America.

We remain committed to delivering always fresh, high quality andsustainably-sourced seafood. We do this in a variety of ways, including support for both wild-caught and farm-raised fishery improvement projects around the world, through our partnership with theWorld Wildlife Fund.

We continue to reduce energy use, which lowers our carbon footprint and helps our bottom line. We have reduced total energy consumption by 32.7 percent since 2000, and are on track to meet our goal of a 35 percent reduction by 2015. We achieve these efficiencies in large ways and small, from designing every new store to earn the U.S. EPA Energy Star rating, to every Associate taking responsibility to turn off lights and check cooler temperatures throughout the day.

You can learn more about our sustainability initiatives by reading our annual sustainability report, available on our websitesustainability.kroger.com.

Kroger is one of the safest companies in our industry. Associate engagement in innovative safety programs hasreduced accident rates in our stores and manufacturing plantsby 76 percent since 1995.

* * *

2

Celebration of Our People

Our shared heritage is the sum total of countless decisions made by Associates through more than a century in business. We invest in our Associates and their families in a variety of ways, including:

A distinct point of pride and celebration for us is the longevity of so many of our Associates. Currently, more than 13,000 of our more than 343,000 Associates have served our Customers for more than 30 years. Nearly 2,000 Associates have served for more than 40 years.

* * *

Enduring Value of Supporting Communities

Over the years, Kroger has undergone several reinventions to meet the changing needs of American families. One thing that has not changed is our ability to make a difference in the lives of our Customers and communities. We partner with local communities through our commitment to feeding the hungry and supporting women’s health, the military and their families, and local organizations and schools.

In 2012, Kroger:

We do these things because our Customers tell us it is important to them and because it strengthens the communities we call home. When you combine the cash, food and product we donate to a variety of causes and programs,Kroger contributed more than $250 million in 2012 to support the communities we serve.

Kroger is a leader in supplier diversity, spending more than$1 billion annually with women- and minority-owned businesses. We proudly remain a member of theBillion Dollar Roundtable and theUnited States Hispanic Chamber of CommerceMillion Dollar Club.

* * *

3

The Year Ahead

Kroger is on pace to deliver another record year. Revenues will approach $100 billion for the first time.

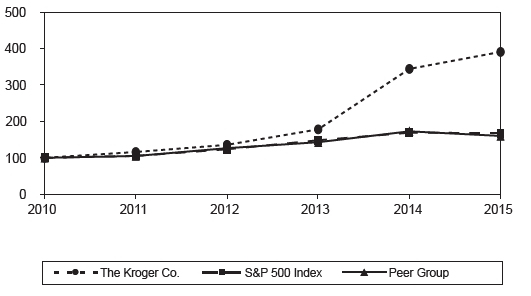

We will continue toexecute our Customer 1st Strategy, coupled with ourrenewed commitment to growth, to make a difference for Customers and create value for Shareholders in 2013. By targeting capital investments to grow our business in new and existing markets and leveraging dunnhumby insights to solve varied Customer needs, we expect to achieve fully diluted earnings per share growth of 8% to 11% plus the dividend over time.

As you can see, the future is bright for Kroger. We are bullish about our ability to sustain the strong momentum that we generated in 2012. In many ways, our fiscal 2012 results served as a great example of our ability to continually grow. We are enthusiastic about all that is to come in the year ahead, which will surely be an exciting and significant one for Kroger.

On behalf of the entire Kroger family, thank you for your continued trust and support.

4

Congratulations to the winners of The Kroger Co. Community Service Award for 2012:

| Where: | School for Creative and Performing Arts | |||||

| Corbett Theater | ||||||

| 108 W. Central Parkway | ||||||

| Cincinnati, OH 45202 | ||||||

| Items of Business: | 1. | To elect eleven director nominees. | ||||

| 2. | ||||||

| 3. | To ratify the selection of our independent auditor for fiscal year 2016. | |||||

5

Notice of Annual Meeting of Shareholders

Cincinnati, Ohio, May 14, 2013

To All Shareholders of The Kroger Co.:

The annual meeting of shareholders of The Kroger Co. will be held at the MUSIC HALL BALLROOM, MUSIC HALL, 1241 Elm Street, Cincinnati, Ohio 45202, on June 27, 2013, at 11 a.m., eastern time, for the following purposes:

| 4. | To | ||

| 5. | To transact other business as may properly come before the meeting. | ||

| Who can Vote: | Holders of Kroger common shares at the close of business on the record date April 27, 2016 are entitled to notice of and to vote at the meeting. | ||

| How to Vote: | Your vote is important! Please vote your proxy in one of the following ways: | ||

| 1. | Via the internet, by visiting www.proxyvote.com. | ||

| 2. | By telephone, by calling the number on your proxy card, voting instruction form or notice. | ||

| 3. | By mail, by marking, signing, dating and mailing your proxy card if you requested printed materials, or your voting instruction form. No postage is required if mailed in the United States. | ||

| 4. | In person, by attending the meeting in Cincinnati. | ||

| Attending the Meeting: | |||

| Webcast of the | If you are unable to attend the meeting, you may listen to a live webcast of the meeting by visiting ir.kroger.com at 11:00 a.m. eastern time on June 23, 2016. | ||

all as set forthWe appreciate your continued confidence in the Proxy Statement accompanying this Notice. Holders of common shares of recordKroger, and we look forward to seeing you at the close of business on April 30, 2013, will be entitled to vote at the meeting.

Attendance

Only shareholders and persons holding proxies from shareholders may attend the meeting.If you are attending the meeting, please bring the notice of the meeting that was separately mailed to you or the top portion of your proxy card, either of which will serve as your admission ticket.

YOUR MANAGEMENT DESIRES TO HAVE A LARGE NUMBER OF SHAREHOLDERS REPRESENTED AT THE MEETING, IN PERSON OR BY PROXY. PLEASE VOTE YOUR PROXY ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE. IF YOU HAVE ELECTED TO RECEIVE PRINTED MATERIALS, YOU MAY SIGN AND DATE THE PROXY AND MAIL IT IN THE SELF-ADDRESSED ENVELOPE PROVIDED. NO POSTAGE IS REQUIRED IF MAILED WITHIN THE UNITED STATES.

If you are unable to attend the annual meeting, you may listen to a live webcast of the meeting, which will be accessible through our website, ir.kroger.com, at 11 a.m., eastern time.

| By | |

| May 12, 2016 | |

| Cincinnati, Ohio |

6

Proxy Statement

Cincinnati, Ohio, May 14, 201312, 2016

YourWe are providing this notice, proxy is solicitedstatement and annual report to the shareholders of The Kroger Co. (“Kroger”) in connection with the solicitation of proxies by the Board of Directors for use at the Annual Meeting of TheShareholders to be held on June 23, 2016, at 11:00 a.m. eastern time, at the School for Creative and Performing Arts, Corbett Theater, 108 W. Central Parkway, Cincinnati, Ohio 45202, and at any adjournments thereof.

Our principal executive offices are located at 1014 Vine Street, Cincinnati, Ohio 45202-1100. Our telephone number is 513-762-4000. This notice, proxy statement and annual report, and the accompanying proxy card were first furnished to shareholders on May 12, 2016.

Who can vote?

You can vote if as of the close of business on April 27, 2016, you were a shareholder of record of Kroger Co.,common shares.

Who is asking for my vote, and who pays for this proxy solicitation?

Your proxy is being solicited by Kroger’s Board of Directors. Kroger is paying the cost of solicitation. We have hired D.F. King & Co., Inc., 48 Wall Street, New York, New York, a proxy solicitation firm to assist us in soliciting proxies and we will be borne by Kroger. pay them a fee estimated not to exceed $15,000.

We also will reimburse banks, brokers, nominees, and other fiduciaries for postage and reasonable expenses incurred by them in forwarding the proxy material to their principals. Kroger has retained D.F. King & Co., Inc., 48 Wall Street, New York, New York, to assist in the solicitationbeneficial owners of proxies and will pay that firm a fee estimated at present not to exceed $15,000. our common shares.

Proxies may be solicited personally, by telephone, electronically via the Internet, or by mail.

David B. Dillon, John T. LaMacchia, and Bobby S. Shackouls, all of whomWho are Kroger directors, have been namedthe members of the Proxy Committee.Committee?

Robert D. Beyer, W. Rodney McMullen, and Ronald L. Sargent, all Kroger Directors, are the members of the Proxy Committee for our 2016 Annual Meeting.

How do I vote my proxy?

You can vote your proxy in one of the following ways:

| 1. | Via the internet,by visiting www.proxyvote.com. | |

| 2. | By telephone,by calling the number on your proxy card, voting instruction form, or notice. | |

| 3. | By mail,by marking, signing, dating and mailing your proxy card if you requested printed materials, or your voting instruction form. No postage is required if mailed in the United States. | |

| 4. | In person,by attending the meeting in Cincinnati. | |

What do I need to attend the meeting in person in Cincinnati?

If you plan to attend the meeting, you must bring either: (1) the notice of meeting that was separately mailed to you or (2) the top portion of your proxy card, either of which will be your admission ticket.

You must also bring valid photo identification, such as a driver’s license or passport.

Can I change or revoke my proxy?

The principal executive offices of The Kroger Co. are locatedcommon shares represented by each proxy will be voted in the manner you specified unless your proxy is revoked before it is exercised. You may change or revoke your proxy by providing written notice to Kroger’s Secretary at 1014 Vine Street, Cincinnati, Ohio 45202-1100. Our telephone number is 513-762-4000. This Proxy Statement45202-1100, in person at the meeting or by executing and Annual Report, and the accompanying proxy, were first furnished to shareholders on May 14, 2013.sending us a subsequent proxy.

How many shares are outstanding?

As of the close of business on April 30, 2013,27, 2016, the record date, our outstanding voting securities consisted of 520,063,320953,786,557 common shares,shares.

1

How many votes per share?

Each common share outstanding on the holders of whichrecord date will be entitled to one vote per share aton each of the annual meeting. The shares represented by11 director nominees and one vote on each proxy will be voted unless the proxy is revoked before it is exercised. Revocation may be in writing to Kroger’s Secretary, or in person at the meeting, or by appointment of a subsequent proxy.other proposal. Shareholders may not cumulate votes in the election of directors.

What voting instructions can I provide?

You may instruct the proxies to vote “For” or “Against” each proposal. Or you may instruct the proxies to “Abstain” from voting.

What happens if proxy cards or voting instruction forms are returned without instructions?

If you are a registered shareholder and you return your proxy card without instructions, the Proxy Committee will vote in accordance with the recommendations of the Board of Directors.

If you hold shares in street name and do not provide your broker with specific voting instructions on proposals 1, 2, 4, 5, 6 or 7, which are considered non-routine matters, your broker does not have the authority to vote on those proposals. This is generally referred to as a “broker non-vote.” Proposal 3, ratification of auditors, is considered a routine matter and, therefore, your broker may vote your shares according to your broker’s discretion.

The vote required, including the effect of broker non-votes and abstentions onfor each of the matters presented for shareholder vote, is as follows:set forth below.

ItemWhat are the voting requirements for each of the proposals?

Proposal No. 1, Election of Directors – An affirmative vote of the majority of the total number of votes cast “for”“For” or “against”“Against” a director nominee is required for the election of a director in an uncontested election. Accordingly, brokerA majority of votes cast means that the number of shares voted “For” a director nominee must exceed the number of votes “Against” such director. Broker non-votes and abstentions will have no effect on this proposal.

ItemProposal No. 2, Advisory Vote to Approve Executive Compensation – ApprovalAdvisory approval by shareholders of executive compensation requires the affirmative vote of the majority of shares participating in the voting. Accordingly, brokerBroker non-votes and abstentions will have no effect on this proposal.

ItemProposal No. 3, SelectionRatification of Independent Auditors – Ratification by shareholders of the selection of independent public accountants requires the affirmative vote of the majority of shares participating in the voting. Accordingly, abstentionsAbstentions will have no effect on this proposal.

ItemProposal Nos. 4, 5, 6 and 7, Shareholder Proposals– The affirmative vote of athe majority of shares participating in the voting on a shareholder proposal is required for its adoption.such proposal to pass. Accordingly, broker non-votes and abstentions will have no effect on these proposals. Proxies will be voted AGAINSTagainst these proposals unless the Proxy Committee is otherwise instructed on a proxy properly executed and returned. Broker non-votes and abstentions will have no effect on these proposals.

How does the Board of Directors recommend that I vote?

| Proposal | Board Recommendation | |

| Item No. 1, Election of Directors | FOR | |

| See pages 4-7 | ||

| Item No. 2, Advisory Vote to Approve Executive Compensation | FOR | |

| See page 49 | ||

| Item No. 3, Ratification of Independent Auditors | FOR | |

| See pages 54-55 | ||

| Item Nos. 4, 5, 6 and 7, Shareholder Proposals | AGAINST | |

| See pages 57-63 |

2

Kroger’s Corporate Governance Practices

Kroger is committed to strong corporate governance. We believe that strong governance builds trust and promotes the long-term interests of our shareholders. Highlights of our corporate governance practices include the following:

| ✓ | All director nominees are independent, except for the CEO. | ||

| ✓ | All five Board Committees are fully independent. | ||

| ✓ | Annual election of all directors. | ||

| ✓ | All directors are elected with a simple majority standard for all uncontested director elections, with cumulative voting available in contested director elections. | ||

| ✓ | Commitment to Board refreshment and diversity. | ||

| ✓ | Regular engagement with shareholders to understand their perspectives and concerns. | ||

| ✓ | Regular executive sessions of the independent directors, at board and committee level. | ||

| ✓ | Strong independent lead director with clearly defined roles and responsibilities. | ||

| ✓ | Annual Board and Committee self-assessments. | ||

| ✓ | Annual evaluation of the Chairman and CEO by the independent directors. | ||

| ✓ | High degree of Board interaction with management to ensure successful oversight and succession planning. | ||

| ✓ | Stock ownership guidelines align executive and director interests with those of shareholders. | ||

| ✓ | Prohibition on all hedging, short sales and pledging. | ||

| ✓ | No poison pill (shareholder rights plan). | ||

| ✓ | Shareholders have the right to call a special meeting. | ||

| ✓ | Robust code of ethics. | ||

| ✓ | Strong Board oversight of enterprise risk. |

3

Proposals to Shareholders

Item 1. Election of Directors(Item No. 1)

You are being asked to elect 11 director nominees for a one-year term. The Board of Directors as now authorized,recommends that you vote FOR the election of all director nominees.

As of the date of this proxy statement, the Kroger Board of Directors consists of fourteentwelve members. David B. Lewis will be retiring from the Board of Directors immediately prior to the 2016 annual meeting, in accordance with Kroger’s director retirement policy, and will not be standing for re-election. The number of directors will be reduced to eleven by the Board. All members are to benominees, if elected at the 2016 annual meeting, towill serve until the annual meeting in 2014,2017, or until their successors have been elected by the shareholders or by the Board of Directors pursuant to Kroger’s Regulations, and qualified.

Kroger’s Articles of Incorporation provide that the vote required for election of a director nominee by the shareholders, except in a contested election or when cumulative voting is in effect, will beis the affirmative vote of a majority of the votes cast for or against the election of a nominee.

The experience, qualifications, attributes, and skills that led the Corporate Governance Committee and the Board to conclude that the following individuals should serve as directors are set forth opposite each individual’s name. The committee memberships stated below are those in effect as of the date of this proxy statement. It is intended that, except to the extent that authority is withheld, proxies will be votedExcept as noted, each nominee has been employed by his or her present employer (or a subsidiary thereof) in an executive capacity for the electionat least five years.

Nominees for Directors for Terms of the following persons:Office Continuing until 2017

| Name | Professional Occupation (1) | Age | Director Since | |||

Nominees for Director for Terms of Office | ||||||

Reuben V. Anderson | Mr. Anderson is a Senior Partner in the Jackson, Mississippi office of Phelps Dunbar, a regional law firm based in New Orleans. Prior to joining this law firm, he was a justice of the Supreme Court of Mississippi. Mr. Anderson is a director of AT&T Inc., and during the past five years was a director of Trustmark Corporation. He is a member of the Corporate Governance and Public Responsibilities Committees. Mr. Anderson has extensive litigation experience, and he served as the first African-American Justice on the Mississippi Supreme Court. His knowledge and judgment gained through years of legal practice are of great value to the Board. In addition, as former Chairman of the Board of Trustees of Tougaloo College and a resident of Mississippi, he brings to the Board his insights into the African-American community and the southern region of the United States. Mr. Anderson has served on numerous board committees, including audit, public policy, finance, executive, and nominating committees. | 70 | 1991 |

Nora A. Aufreiter Age 56 Director Since 2014 Committees: | Ms. Aufreiter is a Director Emeritus of McKinsey & Company, a global management consulting firm. She retired in June 2014 after more than 27 years with McKinsey, most recently as a director and senior partner. During that time, she worked extensively in the U.S., Canada, and internationally with major retailers, financial institutions and other consumer-facing companies. Before joining McKinsey, Ms. Aufreiter spent three years in financial services working in corporate finance and investment banking. She is a member of the Board of Directors of The Bank of Nova Scotia, The Neiman Marcus Group, and Cadillac Fairview, one of North America’s largest owners, operators and developers of commercial real estate. Ms. Aufreiter also serves on the boards of St. Michael’s Hospital and the Canadian Opera Company, and is a member of the Dean’s Advisory Board for the Ivey Business School in Ontario, Canada. Ms. Aufreiter has over 30 years of broad business experience in a variety of retail sectors. Her vast experience in leading McKinsey’s North American Retail Practice, North American Branding service line and the Consumer Digital and Omnichannel service line is of particular value to the Board. She also brings to the Board valuable insight on commercial real estate. |

84

| Name | Professional Occupation (1) | Age | Director Since | |||

Robert D. Beyer | Mr. Beyer is Chairman of Chaparal Investments LLC, a private investment firm and holding company that he founded in 2009. From 2005 to 2009, Mr. Beyer served as Chief Executive Officer of The TCW Group, Inc., a global investment management firm. From 2000 to 2005, he served as President and Chief Investment Officer of Trust Company of the West, the principal operating subsidiary of TCW. Mr. Beyer is a member of the Board of Directors of The Allstate Corporation. He is vice chair of the Corporate Governance Committee and a member of the Financial Policy Committee. Mr. Beyer brings to Kroger his experience as CEO of TCW, a global investment management firm serving many of the largest institutional investors in the U.S. He has exceptional insight into Kroger’s financial strategy, and his experience qualifies him to serve as a member of the Financial Policy Committee. While at TCW, he also conceived and developed the firm’s risk management infrastructure, an experience that is useful to the Kroger Board in performing its risk management oversight functions. His abilities and service as a director were recognized by his peers, who selected Mr. Beyer as an Outstanding Director in 2008 as part of the Outstanding Directors Program of theFinancial Times. | 53 | 1999 | |||

David B. Dillon | Mr. Dillon was elected Chairman of the Board of Kroger in 2004, Chief Executive Officer in 2003, and President and Chief Operating Officer in 2000. He served as President in 1999, and as President and Chief Operating Officer from 1995 to 1999. Mr. Dillon was elected Executive Vice President of Kroger in 1990 and President of Dillon Companies, Inc. in 1986. He is a director of DIRECTV, and during the past five years was a director of Convergys Corporation. Mr. Dillon brings to Kroger his extensive knowledge of the supermarket business, having over 30 years of experience with Kroger and Dillon Companies. In addition to his depth of knowledge of Kroger and the fiercely competitive industry in which Kroger operates, he has gained a wealth of experience by serving on audit, compensation, finance, and governance committees of other boards. | 62 | 1995 |

Robert D. Beyer, Age 56 Director Since 1999 Committees: | Mr. Beyer is Chairman of Chaparal Investments LLC, a private investment firm and holding company that he founded in 2009. From 2005 to 2009, Mr. Beyer served as Chief Executive Officer of The TCW Group, Inc., a global investment management firm. From 2000 to 2005, he served as President and Chief Investment Officer of Trust Company of the West, the principal operating subsidiary of TCW. Mr. Beyer is a member of the Board of Directors of The Allstate Corporation and Leucadia National Corporation. Mr. Beyer has decided not to seek re-election to Allstate’s board of directors at its annual meeting in May 2016, after ten years of service on its board. Mr. Beyer brings to Kroger his experience as CEO of TCW, a global investment management firm serving many of the largest institutional investors in the U.S. He has exceptional insight into Kroger’s financial strategy, and his experience qualifies him to serve as a member of the Board. While at TCW, he also conceived and developed the firm’s risk management infrastructure, an experience that is useful to Kroger’s Board in performing its risk management oversight functions. His abilities and service as a director were recognized by his peers, who selected Mr. Beyer as an Outstanding Director in 2008 as part of the Outstanding Directors Program of the Financial Times. His strong insights into corporate governance form the foundation of his leadership role as Lead Director on the Board. | |

Anne Gates Age 56 Director Since 2015 Committees: | Ms. Gates is President of MGA Entertainment, Inc., a privately-held developer, manufacturer and marketer of toy and entertainment products for children, a position she has held since 2014. Ms. Gates held roles of increasing responsibility with The Walt Disney Company from 1992-2012. Her roles included executive vice president, managing director and chief financial officer for Disney Consumer Products and senior vice president of operations, planning and analysis. Prior to joining Disney, Ms. Gates worked for PepsiCo and Bear Stearns. Ms. Gates has over 15 years of experience in the retail and consumer products industry. She brings to Kroger financial expertise gained while serving as President of MGA and CFO of a division of the Walt Disney Company. Ms. Gates has a broad business background in marketing, strategy and business development, including international business. Her expertise in toy and entertainment products is of particular value to the Board. Ms. Gates has been designated an Audit Committee financial expert. | |

Susan J. Kropf Age 67 Director Since 2007 Committees: | Ms. Kropf was President and Chief Operating Officer of Avon Products Inc., a manufacturer and marketer of beauty care products, from 2001 until her retirement in January 2007. She joined Avon in 1970 and, during her tenure at Avon, Ms. Kropf also served as Executive Vice President and Chief Operating Officer, Avon North America and Global Business Operations from 1998 to 2000 and President, Avon U.S. from 1997 to 1998. Ms. Kropf was a member of Avon’s Board of Directors from 1998 to 2006. She currently is a director of Avon Products Inc., Coach, Inc., and Sherwin Williams Company. In the past five years she also served as a director of MeadWestvaco Corporation. Ms. Kropf has unique and valuable consumer insight, having led a major, publicly-traded retailer of beauty and related consumer products. She has extensive experience in manufacturing, marketing, supply chain operations, customer service, and product development, all of which assist her in her role as a member of Kroger’s Board. Ms. Kropf has a strong financial background, and has significant boardroom experience through her service on the boards of various public companies, including experience serving on compensation, audit, and corporate governance committees. She was inducted into the YWCA Academy of Women Achievers. |

95

| Name | Professional Occupation (1) | Age | Director Since | |||

Susan J. Kropf | Ms. Kropf was President and Chief Operating Officer of Avon Products Inc., a manufacturer and marketer of beauty care products, from 2001 until her retirement in January 2007. She joined Avon in 1970. Prior to her most recent assignment, Ms. Kropf had been Executive Vice President and Chief Operating Officer, Avon North America and Global Business Operations from 1998 to 2000. From 1997 to 1998 she was President, Avon U.S. Ms. Kropf was a member of Avon’s Board of Directors from 1998 to 2006. She currently is a member of the Board of Directors of Coach, Inc., MeadWestvaco Corporation, and Sherwin Williams Company. She is a member of the Audit and Financial Policy Committees. Ms. Kropf has gained a unique consumer insight, having led a major beauty care company. She has extensive experience in manufacturing, marketing, supply chain operations, customer service, and product development, all of which assist her in her role as a member of Kroger’s Board. Ms. Kropf has a strong financial background, and has served on compensation, audit, and corporate governance committees of other boards. She was inducted into the YWCA Academy of Women Achievers. | 64 | 2007 | |||

John T. LaMacchia | Mr. LaMacchia served as Chairman of the Board of Tellme Networks, Inc., a provider of voice application networks, from September 2001 to May 2007. From September 2001 through December 2004 he was also Chief Executive Officer of Tellme Networks. From May 1999 to May 2000 Mr. LaMacchia was Chief Executive Officer of CellNet Data Systems, Inc., a provider of wireless data communications. From October 1993 through February 1999, he was President and Chief Executive Officer of Cincinnati Bell Inc. He is a member of the Compensation and Corporate Governance Committees. Mr. LaMacchia brings to Kroger his tenure leading both large and small companies. He has developed expertise in compensation and governance issues through his experience on compensation and corporate governance committees of Kroger and other boards. | 71 | 1990 | |||

David B. Lewis | Mr. Lewis is a shareholder and director of Lewis & Munday, a Detroit based law firm with offices in Washington, D.C. and New York City. He is a director of H&R Block, Inc. and STERIS Corporation. He is a member of the Financial Policy Committee and vice chair of the Public Responsibilities Committee. In addition to his background as a practicing attorney and expertise in bond financing, Mr. Lewis brings to Kroger’s Board his financial expertise gained while earning his MBA in Finance as well as his service and leadership on Kroger’s audit committee and the board committees of other publicly traded companies. Mr. Lewis has served on the Board of Directors of Conrail, Inc., LG&E Energy Corp., M.A. Hanna, TRW, Inc., and Comerica, Inc. He is a former chairman of the National Association of Securities Professionals. | 68 | 2002 |

W. Rodney McMullen, Age 55 Director Since 2003 | Mr. McMullen was elected Chairman of the Board in January 2015 and Chief Executive Officer of Kroger in January 2014. Mr. McMullen served as Kroger’s President and Chief Operating Officer from August 2009 to December 2013. Prior to that role, Mr. McMullen was elected to various roles at Kroger including Vice Chairman in 2003, Executive Vice President in 1999 and Senior Vice President in 1997. Mr. McMullen is a director of Cincinnati Financial Corporation and VF Corporation. Mr. McMullen has broad experience in the supermarket business, having spent his career spanning over 37 years with Kroger. He has a strong financial background, having served as our CFO, and played a major role as architect of Kroger’s strategic plan. His service on the compensation, executive, and investment committees of Cincinnati Financial Corporation and the audit and nominating and governance committees of VF Corporation add depth to his extensive retail experience. | |

Jorge P. Montoya Age 69 Director Since 2007 Committees: | Mr. Montoya was President of The Procter & Gamble Company’s Global Snacks & Beverage division, and President of Procter & Gamble Latin America, from 1999 until his retirement in 2004. Prior to that, he was an Executive Vice President of Procter & Gamble, a provider of branded consumer packaged goods, from 1995 to 1999. Mr. Montoya is a director of The Gap, Inc. Mr. Montoya brings to Kroger’s Board over 30 years of leadership experience at a premier consumer products company. He has a deep knowledge of the Hispanic market, as well as consumer products and retail operations. Mr. Montoya has vast experience in marketing and general management, including international business. He was named among the 50 most important Hispanics in Business & Technology, inHispanic Engineer & Information Technology Magazine. | |

Clyde R. Moore Age 62 Director Since 1997 Committees: | Mr. Moore was the Chairman of First Service Networks, a national provider of facility and maintenance repair services, until his retirement in 2015. Prior to that he was Chairman and Chief Executive Officer of First Service Networks from 2000 to 2014. Mr. Moore has over 30 years of general management experience in public and private companies. He has sound experience as a corporate leader overseeing all aspects of a facilities management firm and numerous manufacturing companies. Mr. Moore’s expertise broadens the scope of the Board’s experience to provide oversight to Kroger’s facilities, digital and manufacturing businesses. | |

Susan M. Phillips Age 71 Director Since 2003 Committees: | Dr. Phillips is Professor Emeritus of Finance at The George Washington University School of Business. She joined The George Washington University School of Business as a Professor and Dean in 1998. Dr. Phillips retired from her position as Dean in 2010, and retired from her position as Professor the following year. She was a member of the Board of Governors of the Federal Reserve System from December 1991 through June 1998. Before her Federal Reserve appointment, Dr. Phillips served as Vice President for Finance and University Services and Professor of Finance in The College of Business Administration at the University of Iowa from 1987 through 1991. She is a director of CBOE Holdings, Inc., State Farm Mutual Automobile Insurance Company, State Farm Companies Foundation, the Chicago Board Options Exchange, and Agnes Scott College. Dr. Phillips also was a director of the National Futures Association and State Farm Life Insurance Company until early 2016. Dr. Phillips brings to the Board strong financial acumen, along with a deep understanding of, and involvement with, the relationship between corporations and the government. Her experience in academia brings a unique and diverse viewpoint to the Board’s deliberations. Dr. Phillips has been designated an Audit Committee financial expert. |

106

| Name | Professional Occupation (1) | Age | Director Since | |||

W. Rodney McMullen | Mr. McMullen was elected President and Chief Operating Officer of Kroger in August 2009. Prior to that he was elected Vice Chairman in 2003, Executive Vice President in 1999, and Senior Vice President in 1997. Mr. McMullen is a director of Cincinnati Financial Corporation. Mr. McMullen has broad experience in the supermarket business, having spent his career spanning over 30 years with Kroger. He has a strong financial background and played a major role as architect of Kroger’s strategic plan. Mr. McMullen is actively involved in the day-to-day operations of Kroger. His service on the compensation, executive, and investment committees of Cincinnati Financial Corporation adds depth to his extensive retail experience. | 52 | 2003 | |||

Jorge P. Montoya | Mr. Montoya was President of The Procter & Gamble Company’s Global Snacks & Beverage division, and President of Procter & Gamble Latin America, from 1999 until his retirement in 2004. Prior to that, he was an Executive Vice President of Procter & Gamble, a provider of branded consumer packaged goods, from 1995 to 1999. Mr. Montoya is a director of The Gap, Inc. He is chair of the Public Responsibilities Committee and a member of the Compensation Committee. Mr. Montoya brings to Kroger’s Board over 30 years of leadership experience at a premier consumer products company. He has a deep knowledge of the Hispanic market, as well as consumer products and retail operations. Mr. Montoya has vast experience in marketing and general management, including international business. He was named among the 50 most important Hispanics in Business & Technology, inHispanic Engineer & Information Technology Magazine. | 66 | 2007 | |||

Clyde R. Moore | Mr. Moore is the Chairman and Chief Executive Officer of First Service Networks, a national provider of facility and maintenance repair services. He is a director of First Service Networks. Mr. Moore is chair of the Compensation Committee and a member of the Corporate Governance Committee. Mr. Moore has over 25 years of general management experience in public and private companies. He has sound experience as a corporate leader overseeing all aspects of a facilities management firm and a manufacturing concern. Mr. Moore’s expertise broadens the scope of the Board’s experience to provide oversight to Kroger’s facilities and manufacturing businesses. | 59 | 1997 |

11

| Name | Professional Occupation (1) | Age | Director Since | |||

Susan M. Phillips | Dr. Phillips is Professor Emeritus of Finance at The George Washington University School of Business. She joined that university as a Professor and Dean in 1998. She retired as Dean of the School of Business as of June 30, 2010, and as Professor the following year. She was a member of the Board of Governors of the Federal Reserve System from December 1991 through June 1998. Before her Federal Reserve appointment, Dr. Phillips served as Vice President for Finance and University Services and Professor of Finance in The College of Business Administration at the University of Iowa from 1987 through 1991. She is a director of CBOE Holdings, Inc., State Farm Mutual Automobile Insurance Company, State Farm Life Insurance Company, State Farm Companies Foundation, National Futures Association, the Chicago Board Options Exchange, and Agnes Scott College. Dr. Phillips also was a trustee of the Financial Accounting Foundation until the end of 2010. She is a member of the Audit and Compensation Committees. Dr. Phillips brings to the Board strong financial acumen, along with a deep understanding of, and involvement with, the relationship between corporations and the government. Her experience in academia brings a unique and diverse viewpoint to the deliberations of the Board. Dr. Phillips has been designated an Audit Committee financial expert. | 68 | 2003 | |||

Steven R. Rogel | Mr. Rogel was elected Chairman of the Board of Weyerhaeuser Company, a forest products company, in 1999 and was President and Chief Executive Officer and a director thereof from December 1997 to January 1, 2008 when he relinquished the role of President. He relinquished the CEO role in April of 2008 and retired as Chairman as of April 2009. Before that time Mr. Rogel was Chief Executive Officer, President and a director of Willamette Industries, Inc. He served as Chief Operating Officer of Willamette Industries, Inc. until October 1995 and, before that time, as an executive and group vice president for more than five years. Mr. Rogel is a director of Union Pacific Corporation and a director and non-executive Chairman of the Board of EnergySolutions, Inc. He is a member of the Corporate Governance and Financial Policy Committees. Mr. Rogel has extensive experience in management of large corporations at all levels. He brings to the Board a unique perspective, having led a national supplier of paper products prior to his retirement. Mr. Rogel previously served as Kroger’s Lead Director, and has served on compensation, finance, audit, and governance committees of other corporations. | 70 | 1999 |

12

| Name | Professional Occupation (1) | Age | Director Since | |||

James A. Runde | Mr. Runde is a special advisor and a former Vice Chairman of Morgan Stanley, a financial services provider, where he has been employed since 1974. He was a member of the Board of Directors of Burlington Resources Inc. prior to its acquisition by ConocoPhillips in 2006. Mr. Runde serves as a Trustee Emeritus of Marquette University and the Pierpont Morgan Library. He is a member of the Compensation Committee and chair of the Financial Policy Committee. Mr. Runde brings to Kroger’s Board a strong financial background, having led a major financial services provider. He has served on the compensation committee of a major corporation. | 66 | 2006 | |||

Ronald L. Sargent | Mr. Sargent is Chairman and Chief Executive Officer of Staples, Inc., a consumer products retailer, where he has been employed since 1989. Prior to joining Staples, Mr. Sargent spent 10 years with Kroger in various positions. In addition to serving as a director of Staples, Mr. Sargent is a director of Five Below, Inc. During the past five years, he was a director of Mattel, Inc. and The Home Depot, Inc. Mr. Sargent is chair of the Audit Committee and a member of the Public Responsibilities Committee. Mr. Sargent has over 30 years of retail experience, first with Kroger and then with increasing levels of responsibility and leadership at Staples, Inc. His efforts helped carve out a new market niche for the international retailer that he leads. His understanding of retail operations and consumer insights are of particular value to the Board. Mr. Sargent has been designated an Audit Committee financial expert. | 57 | 2006 | |||

Bobby S. Shackouls | Until the merger of Burlington Resources Inc. and ConocoPhillips, which became effective in 2006, Mr. Shackouls was Chairman of the Board of Burlington Resources Inc., a natural resources business, since July 1997 and its President and Chief Executive Officer since December 1995. He had been a director of that company since 1995 and President and Chief Executive Officer of Burlington Resources Oil and Gas Company (formerly known as Meridian Oil Inc.), a wholly-owned subsidiary of Burlington Resources, since 1994. Mr. Shackouls is a director of PNGS GP LLC, the general partner of PAA Natural Gas Storage, L.P., and Oasis Petroleum Inc. During the past five years, Mr. Shackouls was a director of ConocoPhillips. He has been appointed by Kroger’s Board to serve as Lead Director. Mr. Shackouls is chair of the Corporate Governance Committee and a member of the Audit Committee. Mr. Shackouls brings to the Board the critical thinking that comes with a chemical engineering background. His guidance of a major natural resources company, coupled with his corporate governance expertise, forms the foundation of his leadership role on Kroger’s Board. | 62 | 1999 |

James A. Runde Age 69 Director Since 2006 Committees: | Mr. Runde is a special advisor and a former Vice Chairman of Morgan Stanley, a financial services provider, where he was employed from 1974 until his retirement in 2015. He was a member of the Mr. Runde brings to Kroger’s Board a strong financial background, having led a major financial services provider. He has served on the compensation committee of a major corporation. | |

Ronald L. Sargent Age 60 Director Since 2006 Committees: | Mr. Sargent is Chairman and Chief Executive Officer of Staples, Inc., a business products retailer, where he has been employed Mr. Sargent has over 35 years of retail experience, first with Kroger and then with increasing levels of responsibility and leadership at Staples, Inc. His efforts helped carve out a new market niche for the international retailer that he leads. His understanding of retail operations and consumer insights are of particular value to the Board. Mr. Sargent has been designated an Audit Committee financial expert. | |

Bobby S. Shackouls Age 65 Director Since 1999 Committees: | Mr. Shackouls was Chairman of the Board of Burlington Resources Inc., a natural resources business, from July 1997 until its merger with ConocoPhillips in 2006 and its President and Chief Executive Officer from December 1995 until 2006. Mr. Shackouls was also the President and Chief Executive Officer of Burlington Resources Oil and Gas Company (formerly known as Meridian Oil Inc.), a wholly-owned subsidiary of Burlington Resources, from 1994 to 1995. Mr. Shackouls is a director of Plains GP Holdings, L.P. and Oasis Petroleum Inc. During the past five years, Mr. Shackouls was a director of ConocoPhillips and PNGS GP LLC, the general partner of PAA Natural Gas Storage, L.P. Mr. Shackouls previously served as Kroger’s Lead Director. Mr. Shackouls brings to the Board the critical thinking that comes with a chemical engineering background, as well as his |

13The Board of Directors Recommends a VoteFor Each Director Nominee.

7

Information Concerning the Board of Directors

Committees of the Board Leadership Structure and Lead Independent Director

The Board is currently composed of Directorseleven independent non-employee directors and one management director, Mr. McMullen, the Chairman and CEO. Kroger has a number of standing committees including Audit, Compensation,balanced governance structure in which independent directors exercise meaningful and Corporate Governance Committees. All standing committees are composed exclusively of independent directors. All Board committees have charters that can be found on our corporate website at ir.kroger.com undervigorous oversight.

In addition, as provided in theGuidelines on Issues of Corporate Governance. During 2012, (the Audit Committee met five times,“Guidelines”), the Compensation Committee met four times,Board has designated one of the independent directors as Lead Director. The Lead Director works with the Chairman to share governance responsibilities, facilitate the development of Kroger’s strategy and grow shareholder value. The Lead Director serves a variety of roles, consistent with current best practices, including:

| ● | reviewing and approving Board meeting agendas, materials and schedules to confirm theappropriate topics are reviewed and sufficient time is allocated to each; |

| ● | serving as the principal liaison between the Chairman, management and the non-managementdirectors; |

| ● | presiding at the executive sessions of independent directors and at all other meetings of the Boardat which the Chairman is not present; |

| ● | calling meetings of independent directors at any time; and |

| ● | serving as the Board’s representative for any consultation and direct communication, following arequest, with major shareholders. The Lead Director carries out these responsibilities in numerous ways, including: |

| ● | facilitating communication and collegiality among the Board; |

| ● | soliciting direct feedback from non-executive directors; |

| ● | overseeing the succession process, including site visits and meeting with a wide range of corporateand division management associates; |

| ● | meeting with the CEO frequently to discuss strategy; |

| ● | serving as a sounding board and advisor to the CEO; and |

| ● | discussing Company matters with other directors between meetings. |

Unless otherwise determined by the Board, the chair of the Corporate Governance Committee met two times.is designated as the Lead Director. Robert Beyer, an independent director and the chair of the Corporate Governance Committee, memberships are shownis currently the Lead Director. Mr. Beyer is an effective Lead Director for Kroger due to, among other things, his independence, his deep strategic and operational understanding of Kroger obtained while serving as a Kroger director, his insight into corporate governance, his experience on pages 8the boards of other large publicly traded companies, and his commitment and engagement to carrying out the roles and responsibilities of the Lead Director.

With respect to the roles of Chairman and CEO, theGuidelines provide that the Board will determine when it is in the best interests of Kroger and our shareholders for the roles to be separated or combined, and the Board exercises its discretion as it deems appropriate in light of prevailing circumstances. Upon retirement of our former Chairman, David B. Dillon, on December 31, 2014, the Board determined that it is in the best interests of Kroger and our shareholders for one person to serve as the Chairman and CEO, as was the case from 2004 through 132013. The Board believes that this leadership structure improves the Board’s ability to focus on key policy and operational issues and helps the Company operate in the long-term interests of shareholders. Additionally, this structure provides an effective balance between strong Company leadership and appropriate safeguards and oversight by independent directors. The Board believes that the combination or separation of these positions should continue to be considered as part of the succession planning process, as was the case in 2003 and 2014 when the roles were separated.

8

The Board and each of its committees conduct an annual self-evaluation to determine whether the Board is functioning effectively at each level. As part of this Proxy Statement.annual self-evaluation, the Board assesses whether the current leadership structure continues to be appropriate for Kroger and its shareholders. The Audit Committee reviews financial reporting and accounting matters pursuantGuidelines provide the flexibility for the Board to its charter and selectsmodify our independent accountants. The Compensation Committee recommends for determinationleadership structure in the future as appropriate. We believe that Kroger, like many U.S. companies, has been well-served by the independent members of our Board the compensationthis flexible leadership structure.

Committees of the Chief Executive Officer, determinesBoard of Directors

To assist the compensationBoard in undertaking its responsibilities, and to allow deeper engagement in certain areas of Kroger’s other senior management,company oversight, the Board has established five standing committees: Audit, Compensation, Corporate Governance, Financial Policy and administers somePublic Responsibilities. All committees are composed exclusively of independent directors, as determined under the NYSE listing standards. The current charter of each Board committee is available on our incentive programs. Additional information on the Compensation Committee’s processes and procedures for consideration of executive compensation are addressed in the Compensation Discussion and Analysis below. website at ir.kroger.com under Corporate Governance – Committee Composition.

| Name of Committee, Number of Meetings, and Current Members | Committee Functions | |

Audit Committee Meetings in 2015:5 Members: | ●Oversees the Company’s financial reporting and accounting matters, including review of the Company’s financial statements and the audit thereof, the Company’s financial reporting and accounting process, and the Company’s systems of internal control over financial reporting ●Selects, evaluates and oversees the compensation and work of the independent registered public accounting firm and reviews its performance, qualifications, and independence ●Oversees and evaluates the Company’s internal audit function, including review of its audit plan, policies and procedures and significant findings ●Oversees risk assessment and risk management, including review of legal or regulatory matters that could have a significant effect on the Company ●Reviews and monitors the Company’s compliance programs, including the whistleblower program | |

Compensation Committee Meetings in 2015:5 Members: | ●Recommends for approval by the independent directors the compensation of the CEO, and determines the compensation of other senior management and directors ●Administers the Company’s executive compensation policies and programs, including determining grants of equity awards under the plans ●Has sole authority to retain and direct the committee’s compensation consultant ●Assists the full Board with senior management succession planning |

9

| Name of Committee, Number of Meetings, and Current Members | Committee Functions |

Corporate Governance Committee | ●Oversees the Company’s corporate governance policies and procedures ●Develops criteria for selecting and retaining directors and identifies and recommends qualified candidates to be director nominees ●Designates membership and chairs of Board committees ●Reviews the Board’s performance and director independence ●Reviews, along with the other independent directors, the performance of the CEO |

Financial Policy Committee | ●Reviews and recommends financial policies and practices ●Oversees management of the Company’s financial resources ●Reviews the Company’s annual financial plan, significant capital investments, plans for major acquisitions or sales, issuance of new common or preferred stock, dividend policy, creation of additional debt and other capital structure considerations including additional leverage or dilution in ownership ●Monitors the investment management of assets held in pension and profit sharing plans administered by the Company |

Public Responsibilities Committee | ●Reviews the Company’s policies and practices affecting its social and public responsibility as a corporate citizen, including: community relations, charitable giving, supplier diversity, sustainability, government relations, political action, consumer and media relations, food and pharmacy safety and the safety of customers and employees ●Reviews and examines the Company’s evaluation of and response to changing public expectations and public issues affecting the business |

Director Nominee Selection Process

The Corporate Governance Committee develops criteriais responsible for selecting and retaining members ofrecommending to the Board seeks out qualified candidatesa slate of nominees for the Board, and reviews the performanceelection at each annual meeting of the Board and, along with the other independent board members, the CEO.

shareholders. The Corporate Governance Committee will consider shareholderrecruits candidates for Board membership through its own efforts and through recommendations for nominees for membership on the Board of Directors. Recommendations relating to our annual meeting in June 2014, together with a description of the proposed nominee’s qualifications, backgroundfrom other directors and experience, must be submitted in writing to Paul W. Heldman, Secretary, and received at our executive offices not later than January 14, 2014. The shareholder also should indicate the number of shares beneficially owned by the shareholder. The Secretary will forward the information toshareholders. In addition, the Corporate Governance Committee for its consideration. The Committee will usehas retained an independent search firm to assist in identifying and recruiting director candidates who meet the same criteria in evaluating candidates submitted by shareholders as it uses in evaluating candidates identifiedestablished by the Corporate Governance Committee.

These criteria are:

| ● | Demonstrated ability in fields considered to be of value in the deliberation and long-term planningof the Board, including business management, public service, education, technology, law andgovernment; |

| ● | Highest standards of personal character and conduct; |

| ● | Willingness to fulfill the obligations of directors and to make the contribution of which he or she iscapable, including regular attendance and participation at Board and committee meetings, andpreparation for all meetings, including review of all meeting materials provided in advance of the meeting;and |

| ● | Ability to understand the perspectives of Kroger’s customers, taking into consideration the diversityof our customers, including regional and geographic differences. |

10

Racial,The Corporate Governance Committee considers racial, ethnic and gender diversity is anto be important elementelements in promoting full, open and balanced deliberations of issues presented to the Board, and is considered by theBoard. The Corporate Governance Committee.Committee considers director candidates that help the Board reflect the diversity of our shareholders, associates, customers and the communities in which we operate. Some consideration also is given to the geographic location of director candidates in order to provide a reasonable distribution of members from Kroger’s operating areas.

At least annually, the operating areas of the Company.

Corporate Governance Committee actively engages in Board succession planning. The Corporate Governance Committee typically recruitstakes into account the Board and committee evaluations regarding the specific backgrounds, skills, and experiences that would contribute to overall Board and committee effectiveness as well as the future needs of the Board and its committees in light of Kroger’s current and future business strategies and the skills and qualifications of directors who are expected to retire in the future.

Candidates Nominated by Shareholders

The Corporate Governance Committee will consider shareholder recommendations for nominees for membership on the Board of Directors. If shareholders wish to nominate a person or persons for election to the Board at our 2017 annual meeting, written notice must be submitted to Kroger’s Secretary, and received at our executive offices, in accordance with Kroger’s Regulations, not later than March 28, 2017. Such notice should include the name, age, business address and residence address of such person, the principal occupation or employment of such person, the number of Kroger common shares owned of record or beneficially by such person and any other information relating to the person that would be required to be included in a proxy statement relating to the election of directors. The Secretary will forward the information to the Corporate Governance Committee for its consideration. The Corporate Governance Committee will use the same criteria in evaluating candidates for Board membership through its own efforts and through suggestions from other directors and shareholders. The Committee on occasion has retained an outside search firm to assistsubmitted by shareholders as it uses in identifying and recruiting Boardevaluating candidates who meet the criteria establishedidentified by the Committee.Corporate Governance Committee, as described above.

Corporate Governance Guidelines

The Board of Directors has adopted theGuidelines on Issues of Corporate Governance. TheseTheGuidelines, which include copies of the current charters for each of the Audit, Compensation, and Corporate Governance Committees, and the otherfive standing committees of the Board, of Directors, are available on our corporate website at ir.kroger.com.ir.kroger.com under Corporate Governance – Highlights. Shareholders may obtain a copy of theGuidelines by making a written request to Kroger’s Secretary at our executive offices.

14Independence

Independence

The Board of Directors has determined that all of the non-employee directors with the exception of Messrs. Dillon and McMullen, have no material relationships with Kroger and, therefore, are independent for purposes of the New York Stock Exchange listing standards. The Board made its determination based on information furnished by all members regarding their relationships with Kroger.Kroger and its management, and other relevant information. After reviewing the information, the Board determined that all of the non-employee directors were independent because (i) because:

| ● | they all satisfied the criteria for independence set forth in Rule 303A.02 of the NYSE ListedCompany Manual, |

| ● | the value of any business transactions between Kroger and entities with which the directors areaffiliated falls below the thresholds identified by the NYSE listing standards, and |

| ● | none had any material relationships with Kroger except for those arising directly from theirperformance of services as a director for Kroger. |

In determining that Mr. Sargent is independent, the independence standards set forth in Rule 10A-3 of the Securities Exchange Act of 1934, (ii) they all satisfied the criteria for independence set forth in Rule 303A.02 of the New York Stock Exchange Listed Company Manual, and (iii) other than businessBoard considered transactions during fiscal 2015 between Kroger and entities with whichStaples, Inc. (where Mr. Sargent is Chairman and CEO) and determined that the directors are affiliated, the valueamount of which fallsbusiness fell below the thresholds identifiedset by the New York Stock ExchangeNYSE listing standards, none had any material relationships with us except for those arising directly from their performancestandards. The transactions involved the purchase of services asgoods by Kroger in the ordinary course of business totaling approximately $12 million and represented less than 0.06% of Staples’ annual consolidated gross revenue. Kroger periodically employs a director for Kroger.

Lead Director

Kroger’s Lead Director serves in a variety of roles, including reviewing and approving all Board meeting agendas, meeting materials and schedules to ensure that the appropriate topics are reviewed and that sufficient time is allocated to each; serving as a liaison between the chairman of the Board, management, and the non-management directors; presiding at the executive sessions of independent directors (held after each Board meeting) and at all other meetings of the Board at which the chairman is not present; calling an executive session of the independent directors at any time; and serving as the Board’s representative for any consultation and direct communication,bidding process or negotiations following a request, with major shareholders. Unless otherwise determined bybenchmarking of costs of products from various vendors for the Board,items purchased from Staples and awards the chairbusiness based on the results of the Corporate Governance Committee is designated as the Lead Director.that process.

11

Audit Committee Expertise

The Board of Directors has determined that Anne Gates, Susan M. Phillips and Ronald L. Sargent, independent directors who are members of the Audit Committee, are “audit committee financial experts” as defined by applicable SEC regulations and that all members of the Audit Committee are “financially literate” as that term is used in the NYSE listing standards.standards and are independent in accordance with Rule 10A-3 of the Securities Exchange Act of 1934.

Code of Ethics

The Board of Directors has adoptedThe Kroger Co. Policy on Business Ethics, applicable to all officers, employees and members of the Board of Directors,directors, including Kroger’s principal executive, financial and accounting officers. ThePolicy is available on our corporate website at ir.kroger.com.ir.kroger.com under Corporate Governance – Highlights. Shareholders may also obtain a copy of thePolicy by making a written request to Kroger’s Secretary at our executive offices.

Communications with the Board

The Board has established two separate mechanisms for shareholders and interested parties to communicate with the Board. Any shareholder or interested party who has concerns regarding accounting, improper use of Kroger assets or ethical improprieties may report these concerns via the toll-free hotline (800-689-4609) or email address (helpline@kroger.com) established by the Board’s Audit Committee. The concerns are investigated by Kroger’s Vice President of Auditing and reported to the Audit Committee as deemed appropriate by the Vice President of Auditing.

Shareholders or interested parties also may communicate with the Board in writing directed to Kroger’s Secretary at our executive offices. The Secretary will consider the nature of the communication and determine whether to forward the communication to the chair of the Corporate Governance Committee. Communications relating to personnel issues or our ordinary business operations, or seeking to do business with us, will be forwarded to the business unit of Kroger that the Secretary deems appropriate. All other communications will be forwarded to the chair of the Corporate Governance Committee for further consideration. The chair of the Corporate Governance Committee will take such action as he or she deems appropriate, which may include referral to the full Corporate Governance Committee or the entire Board.

15Attendance

Attendance

The Board of Directors held sevenfive meetings in 2012.fiscal year 2015. During 2012,fiscal year 2015, all incumbent directors attended at least 75% of the aggregate number of meetings of the Board and committees on which that director served. Members of the Board are expected to use their best efforts to attend all annual meetings of shareholders. All fourteeneleven members ofthen serving on the Board attended last year’s annual meeting.

Independent Compensation Consultants

The Compensation Committee directly engages a compensation consultant from Mercer Human Resource Consulting to advise the Compensation Committee in the design of compensation forKroger’s executive officers.compensation. In 2012,2015, Kroger paid that consultant $135,573$390,767 for work performed for the Compensation Committee. Kroger, on management’s recommendation, retained the parent and affiliated companies of Mercer Human Resource Consulting to provide other services for Kroger in 2012,2015, for which Kroger paid $2,541,660.$2,339,577. These other services primarily related to insurance claims (for which Kroger was reimbursed by insurance carriers as claims were adjusted), insurance brokerage and bonding commissions provided by Marsh USA Inc., and pension consulting.plan compliance and actuary services provided by Mercer Inc. Kroger also made payments to affiliated companies for insurance premiums that were collected by the affiliated companies on behalf of insurance carriers, but these amounts are not included in the totals referenced above, as the amounts were paid over to insurance carriers for services provided by those carriers.

12

Although neither the Compensation Committee nor the Board expressly approved the other services, after taking into consideration the NYSE’s independence standards and the SEC rules, the Compensation Committee determined that the consultant is independent because (a) he was first engaged by the Committee before he became associated with Mercer; (b) he works exclusively for the Committee and his work has not for our management; (c) he does not benefit from the other work that Mercer’s parent and affiliated companies perform for Kroger; and (d) raised any conflict of interest because:

| ● | the consultant was first engaged by the Compensation Committee before he became associatedwith Mercer; |

| ● | the consultant works exclusively for the Compensation Committee and not for our management; |

| ● | the consultant does not benefit from the other work that Mercer’s parent and affiliated companiesperform for Kroger; and |

| ● | neither the consultant nor the consultant’s team perform any other services for Kroger. |

The Compensation Committee may engage an additional compensation consultant from time to time as it deems advisable.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was an officer or employee of Kroger during fiscal 2015, and no member of the Compensation Committee is a former officer of Kroger or was a party to any disclosable related person transaction involving Kroger. During fiscal 2015, none of our executive officers served on the board of directors or on the compensation committee of any other services on behalfentity that has or had executive officers serving as a member of Kroger.Kroger’s Board of Directors or Compensation Committee of the Board.

Board Oversight of Enterprise Risk

While risk management is primarily the responsibility of Kroger’s management team, the Board of Directors is responsible for thestrategic planning and overall supervision of our risk management activities. The Board’s oversight of the material risks faced by Kroger occurs at both the full Board level and at the committee level.

The Board’s Audit Committee has oversight responsibility not only for financial reporting of Kroger’s major financial exposures and the steps management has taken to monitor and control those exposures, but also for the effectiveness of management’s processes that monitor and manage key business risks facing Kroger, as well as the major areas of risk exposure and management’s efforts to monitor and control that exposure. The Audit Committee also discusses with management its policies with respect to risk assessment and risk management.

Management, including Kroger’s Chief Ethics and Compliance Officer, provides regular updates throughout the year to the respective committees regarding the management of the risks they oversee, and each of these committees reports on risk to the full Board at each regular meeting of the Board.

In addition to the reports from the committees, the Board receives presentations throughout the year from various department and business unit leaders that include discussion of significant risks as necessary. At each Board meeting, the Chairman and CEO addresses matters of particular importance or concern, including any significant areas of risk that require Board attention. Additionally, through dedicated sessions focusing entirely on corporate strategy, the full Board reviews in detail Kroger’s short- and long-term strategies, including consideration of significant risks facing Kroger and their potential impact. The independent directors, in executive sessions led by the Lead Director, address matters of particular concern, including significant areas of risk, that warrant further discussion or consideration outside the presence of Kroger employees. At the committee level, reports are given by management subject matter experts to each committee on risks within the scope of their charters.

The Audit Committee has oversight responsibility not only for financial reporting of Kroger’s major financial exposures and the steps management has taken to monitor and control those exposures, but also for the effectiveness of management’s processes that monitor and manage key business risks facing Kroger, as well as the major areas of risk exposure and management’s efforts to monitor and control that exposure. The Audit Committee also discusses with management its policies with respect to risk assessment and risk management.

Management, including our Chief Ethics and Compliance Officer, provides regular updates throughout the year to the respective Board committees regarding management of the risks they oversee, and each of these committees reports on risk to the full Board at each regular meeting of the Board.

We believe that our approach to risk oversight, as described above, optimizes our ability to assess interrelationshipsinter-relationships among the various risks, make informed cost-benefit decisions, and approach emerging risks in a proactive manner for Kroger. We also believe that our risk structure complements our current Board leadership structure, as it allows our independent directors, through the five fully independent Board committees, and

16